PRODUCT SHEET

EROAD Electronic IFTA

Recordkeeping without the chase

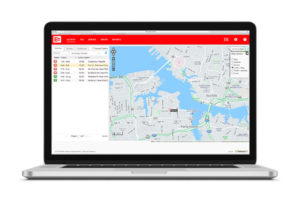

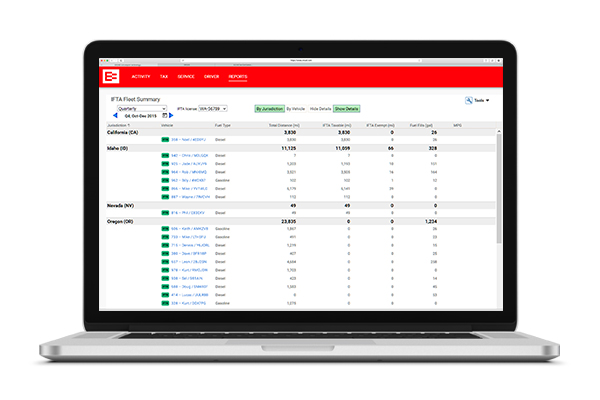

At EROAD, we’ve revolutionized the IFTA (International Fuel Tax Agreement) recordkeeping experience – eliminating the need to chase down driver records, sift through paperwork, and manually enter information. With EROAD’s in-vehicle device, you’ll be confident your entire fleet’s data is accurately captured and securely transmitted. EROAD’s rapid ping rate, powerful mapping engine, and sophisticated geofence tool are unmatched in the industry, allowing you to recreate every mile of every driver’s journey to support accurate, reliable, and auditable distance recordkeeping for tax purposes.

EROAD’s Electronic IFTA automatically generates the required trip information including accurate distance, location, and state line crossing information to support IFTA distance requirements.

Key Benefits:

- Save time

- Pay only what you owe

- Feel confident

- Stay Compliant

- Harness your data