“Our new Electronic IRP simplifies the IRP recordkeeping and application process for carriers,” said Gail Levario, vice president, strategy and market development at EROAD. “This solution captures, records and manages information in one place, eliminating the need to chase down driver records, sift through paperwork, and reduce the time-intensive registration renewal process. We’ve added Electronic IRP to our best-in-class electronic tax solution to further reduce administrative time and paperwork required for complete management of recordkeeping compliance using highly accurate fleet data.”

EROAD’s Electronic IRP automatically generates required trip information including distance, location, and state line crossings to support distance record requirements for IRP and to calculate apportionment percentages by fleet, jurisdiction and vehicle. All data is accurately captured and securely transmitted by EROAD’s in-vehicle device to its Depot web-based application.

Key Features of EROAD IRP Electronic Registration Management include:

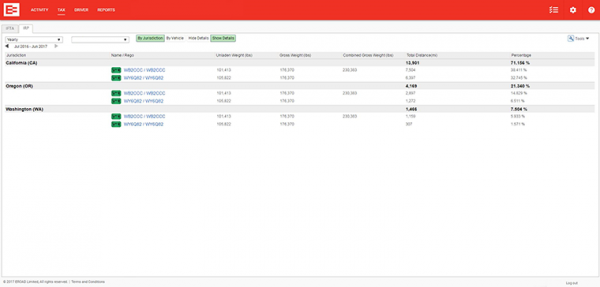

Electronic Recordkeeping – IRP Vehicle Trip Records display mileage information such as distance, routes of travel, and state line crossings per vehicle per month. The application provides summaries by fleet, jurisdiction, and vehicle for recordkeeping and audit purposes.

Advanced Reporting – Automatically combines mileage information from the in-vehicle device to display and report distance and location traveled by vehicle and calculates IRP apportionment percentages for each jurisdiction and vehicle.

IRP Fleet and Vehicle Management – Set up and manage IRP apportioned vehicles and organize them by fleet to speed up the IRP application and annual registration and renewal process. Record and maintain details about each vehicle required for IRP.

Equipment List – View and export detailed information about vehicles for the yearly IRP registration fee process.

“EROAD’s tax reporting is great,” said Chuck Fuller, transportation manager at Umpqua Dairy. “Our Oregon State Public Utilities Commission reports would take a couple of days and now it takes ten minutes. IFTA tax returns have gone from hours to minutes. We truly can’t say enough about EROAD as a product and their support staff.”

EROAD’s all-in-one platform, including its ELD + Tax Compliance solution, is specifically designed to meet compliance, operational and driver needs, both in-vehicle and through a secure web portal. Designed from the ground up with the driver in mind, the highly accurate and reliable solution is intuitive, easy to use and offered at no upfront cost.

Media Contact:

Susan Fall

LaunchIt Public Relations

858-490-1050

susan@launchitpr.com