A better way to manage your fleet

Outmaneuver your competition with a partner who delivers actionable insights to improve your fleet performance.

Unparalleled fleet performance insights

for the modern world

Leverage the power of our fleet performance management platform

built for the Transportation, Food and Beverage, Construction, Waste and Recycling industries.

Transform Your Fleet’s Performance

Harness the power of data to enhance your fleet performance.

Simplify Tax and Compliance

End manual record keeping with solutions that automate hours-of-service (HOS), ELD, DVIR, fuel taxes and digitize key workflow and administrative functions.

Obtain Deeper Insights into Your

Cold Chain

Protect your most sensitive goods. Control every aspect of your cold chain transportation journey, from two-way reefer controls, asset tracking, driver behavior, vehicle inspections and true ETA.

Enhance Fleet Safety

Improve outcomes, reduce costs, and encourage safer journeys using video telematics and advanced driver insights.

Streamline Vehicle Maintenance & Service

Reduce costly unplanned repairs and extend the life of your fleet.

Reduce Your Carbon Footprint

Lower fuel costs and reduce harmful emissions.

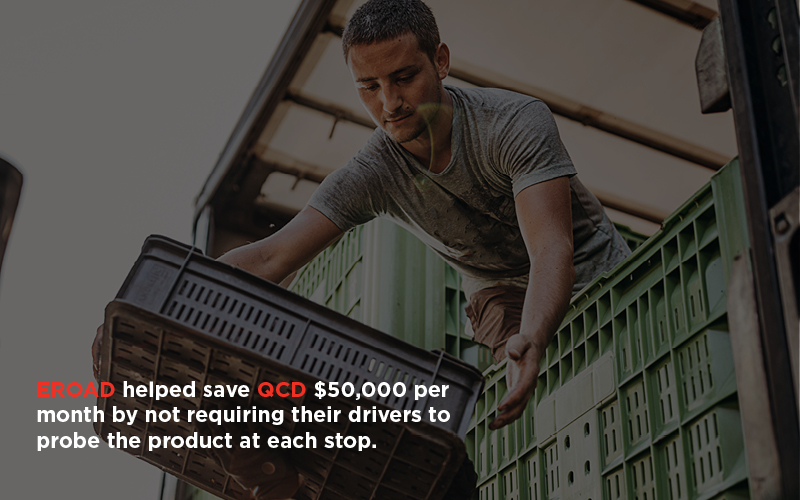

The road ahead is clear. Just ask our customers.

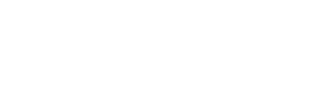

It all starts with CoreHub, not your average fleet telematics device.

CoreHub is the future of fleet management. Sitting discreetly inside the cab, CoreHub collects data directly from the engine management system and other connected devices and sensors to transform your vehicle into an IoT hub. Easily add an ELD, dashcam, and a series of connected wireless sensors to track and monitor door alerts, concrete mixer drum rotations, water moisture levels and more—guess less, know more.

Industries we serve

Our footprint

What’s New

Recent news, media, and press

EROAD Collaborates With BCMI Customers will benefit from better driver communication and additional functionality across platforms in choosing BCMI and EROAD as ready-mix technology providers.

EROAD Releases Product Enhancements for Winter 2024 The EROAD team made several updates to our MyEROAD and Core360 fleet management platforms.

Get in Touch

See how EROAD can make a difference for your fleet. Get in touch with an EROAD expert today.