Fleet compliance without question

Easily manage HOS, DVIR, IFTA and IRP compliance with EROAD’s industry leading ELD solution.

EROAD helps you improve fleet compliance, boost CSA scores and prepare for audits

Save time in the office: no more chasing down drivers for reports and easy reporting to support audits

Benefits

Keep your team safe and in compliance with accurate and consistent data you can count on

Less paperwork for drivers: mileage, state line crossings and route info is captured and transmitted automatically with EROAD’s sophisticated tax software

EROAD’s fleet compliance service features

EROAD takes the headaches out of fleet compliance, reliably capturing accurate data without the gaps and connectivity issues that plague some solutions and put your compliance at risk. Easily manage HOS, DVIR, IFTA and IRP compliance with EROAD’s industry-leading ELD solution.

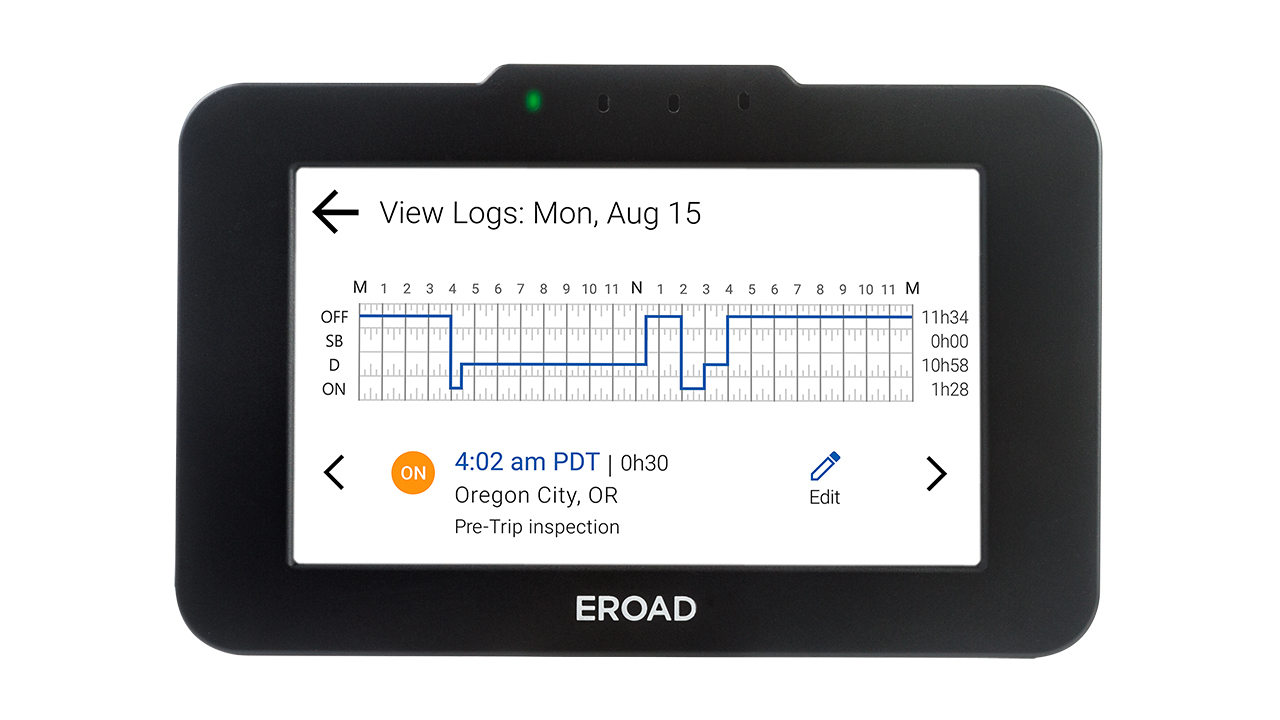

ELD

Accurate, consistent and easy to use, EROAD’s ELD function is 3rd-party certified to meet all FMCSA requirements.

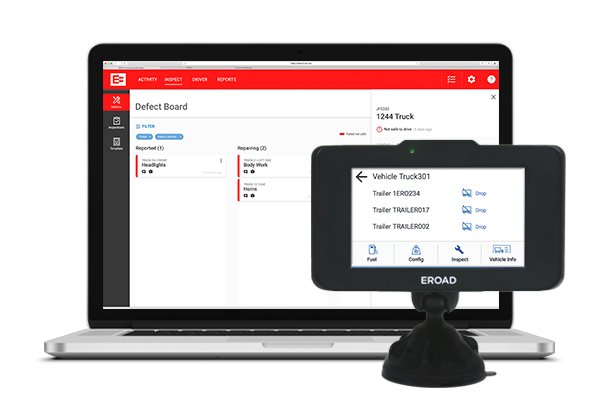

DVIR

Electronic IRP

Automatically generate the required trip data including miles driven, jurisdiction, and state line crossings to support IRP registrations.

IFTA Easy File

Generate a file that can be used as your IFTA return with a click of a button in jurisdictions where available.

Electronic Oregon WMT & RUAF

Automatically generate and submit required trip data including miles, jurisdiction, location, weight/axle configuration and state line crossings to meet requirements. Pay directly with the click of a button.

EROAD’s ELD is designed with the driver in mind

Take the hassles out of HOS compliance with an ELD solution that gives you superior ease of use, accuracy and consistency.

Take the work out of fuel tax reporting

Tax and IRP filings that used to take hours can be done in minutes. And no more trip reports for drivers.

Learn how EROAD helps improve fuel tax reporting and IRP registration

EROAD Inspect puts DVIR compliance at your fingertips

FMCSA compliant, EROAD Inspect helps you gain visibility while streamlining pre-trip and post-trip inspections.

Learn about our driver vehicle inspection report (DVIR) solution

“With EROAD, we haven’t had a driver with even a single HOS violation. It’s a great deal simpler to use than any of the 30 other ELDs we tested. It takes most drivers 15 minutes to learn to operate it and we can even train older drivers not as comfortable with technology in less than an hour.”

John Madison

Director of Safety & Regulatory Compliance

Project Manager, JAS Trucking

Do you have drivers operating short haul?

Maximize productivity and peace of mind with EROAD’s Smart Short Haul.

Recommended resources

CASE STUDY: Recoil Oilfield Services

See how Recoil Oilfield Services is saving more than $200,000 per year by reducing tax reporting labor and maximizing off-road exemptions.

CHECKLIST: Get ready for Brake Safety Week

Use this 12-point preparation checklist to get drivers and vehicles ready to pass inspections successfully.

WEBINAR: CSA Improvement Series – Taking control of your HOS BASIC

This second video in our three-part CSA improvement series shows you how to address form and manner, unidentified trips, data transfers and more.

Is self-certification enough?

EROAD’s ELD solution is certified by the PIT Group, an independent testing organization, and meets FMCSA requirements.

Get a demo

See how EROAD can make a difference for your fleet. Reach out to schedule a 15-minute demo with an EROAD expert today.